Capital One Discover Financial merger

Posted in :

Writing from my experience on credit card both from consumer (outside) and business (inside) perspective: meaning encourage more usage of the card via loyalty and rewards, make sure the card is on the top of the deck etc. I also understand Americans are addicted to the credit card to a large extent. Full disclosure: between 2015 and 2019 yours truly worked for the Mastercard loyalty and rewards department on Biz Ops (production support, Site Reliability Engineering, and product support), and Application Development (software engineering).

I wrote many blog posts on the credit card over the years (such as this one, and that one): mostly from a consumer point of view. I also maintain a my WP page on credit card.

News coverage on the merger

Note I call them merger instead of outright acquisition, because it’s essentially a 60/40 all stock transaction. Meaning the Capital One shareholders will get 60% of the combined company, the Discover shareholder will get 40%. While it’s not 50% to 50%, I think it’s close enough for merger.

CNBC (Hugh Son) – Here’s why Capital One is buying Discover in the biggest proposed merger of 2024

The deal, if approved, enables Capital One to leapfrog JPMorgan as the biggest credit card company by loans, and solidifies its position as the third largest by purchase volume. — Personally I am not ready to give up my CSP card for the Capital One Venture card.

‘Holy Grail’

But it’s Discover’s payments network — the “rails” that shuffle digital dollars between consumers and merchants, collecting tolls along the way — that Fairbank repeatedly praised Tuesday when analysts queried him on the strategic merits of the deal. There are only four major card networks: giants Visa

and Mastercard

, then American Express

and finally the smallest of the group, Discover. (I agree 100%. Credit card network is just like a financial highway. Not toll free. Most everyone has to pay. 信用卡网络就像一个收费的金融高速公路。)

NBCNews – Capital One-Discover merger could put a bigger squeeze on credit card users, experts warn – Many of the largest credit card issuers already charge steeper rates than smaller ones.

The average credit card interest rate in the U.S. is 24.61%, according to LendingTree, the highest since the credit marketplace began tracking monthly rates in 2019. I felt for those cardholders who pay 24.61% or more 🙁 I don’t think even Warren Buffett can easily earn this kind of return in his investments (even with a smaller sum).

USAToday – Discover’s merger with Capital One may mean luxe lounges, better service, plus more perks

The acquisition would give Capital One access to Discover’s high-credit-quality customers and its network of payment processing services, an area dominated by Visa and Mastercard. (Both are not very accurate in my opinion. I will explain them below.)

The deal will create the largest U.S. card issuer with around $250 billion in card balances and a market share of 22%, according to TD Cowen. (This may be true)

FAQs on credit card

What is credit card network? How does it work?

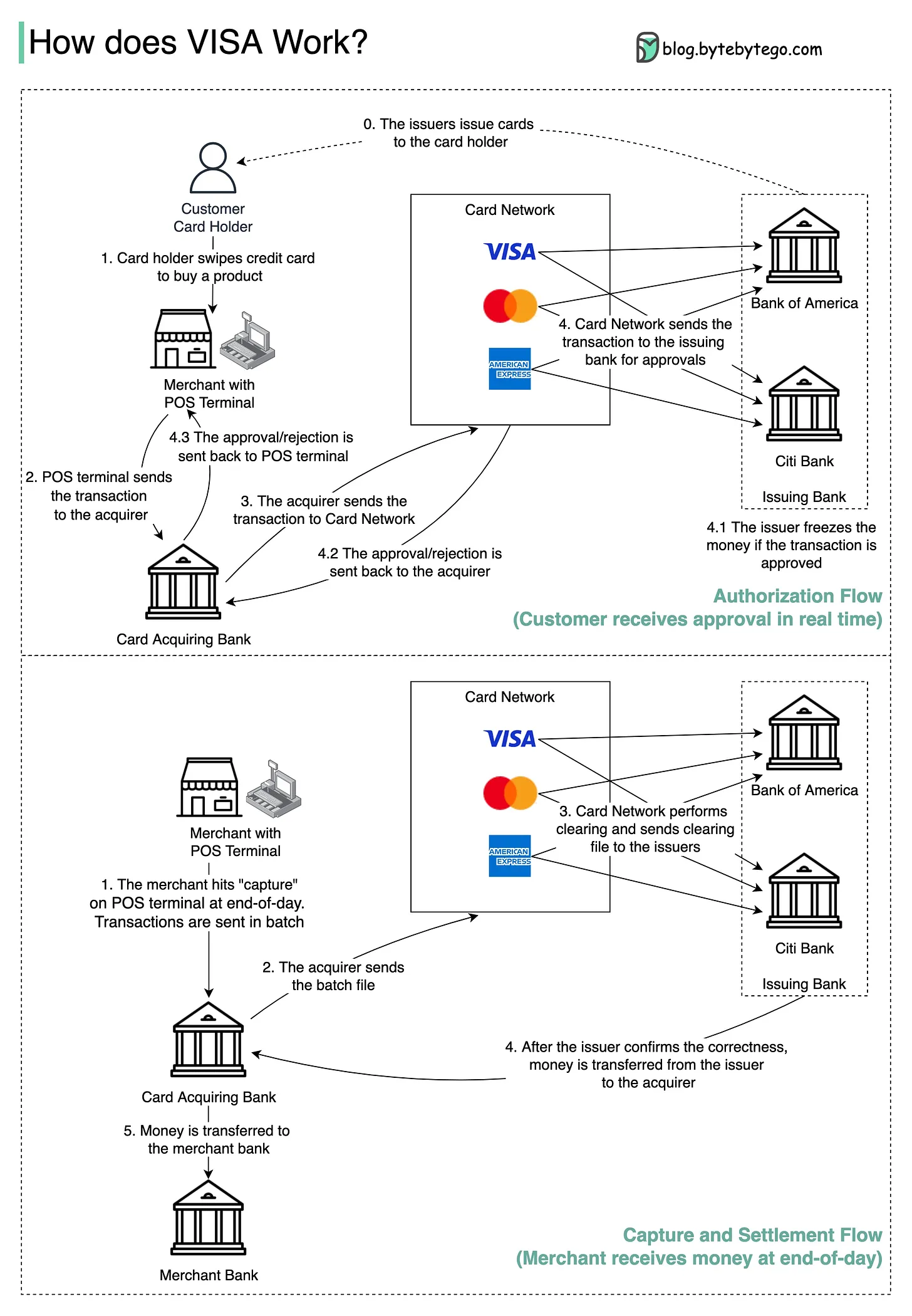

I just saw Stripe has a good text explanation. A picture is worth a thousand words sometimes. For that in ByteByteGo (my friend Alex Xu) I trust. See below. Discover is similar to Visa, Mastercard and American Express when we talk about credit card network (card swiping in the old days, now it’s tapping or digital wallet pay).

How does credit card companies make money?

In simple words, they collect network usage fees from the user of the credit card, initially from the merchant (via the merchant bank). For example, a consumer paid $100 at grocery store using a Chase Visa credit card. Typically the grocery store will eventually get about $97 from the merchant bank. Visa (the credit card network) will receive about 20 to 30 cents. The Chase bank will receive about $2.00 and the rest may go to the people (companies) who setup the payment terminal, merchant bank and so on. One may wonder why Chase bank (the credit card) issuer gets $2.00 which seems like a lot: note that money is not risk free. For example, if the consumer (the Chase credit card customer) didn’t pay her/his credit card bill, in theory Chase will take the loss. But banks usually are not that nice: they will pursue collection, hike interest rate etc. If someone is living on credit cards, basically he/she will be the “slaves” of the bank. 这里是一个具体的例子,下面是引用。

“……顾晓敏还提到,外卡刷卡手续费高昂,单笔费率基本上在2.5%到3.5%不等,而支付宝单笔费率仅为3.8‰,因此很多商户更愿意让外国人使用现金或支付宝、微信,外卡刷卡率仅为23.19%。……”

US credit card networks by processing volume

I also did google search on US credit card networks by processing volume. Below are some results.

Visa accounted for just over half of the purchase volume on general purpose credit cards in 2022:

Visa credit: 52%, $2.84 trillion.

Mastercard credit: 24%, $1.32 trillion.

American Express credit: 20%, $1.08 trillion.

Discover credit: 4%, $211 billion.

UpgradePoints (It seems the year 2022 “processing volume” data may not be correct)

What is credit card issuer?

Credit card issuers are the banks, or credit unions. Note American Express and Discover Financial are also credit card issuers, in addition to providing their respective credit card network.

Trivia Question or bonus question: do you know the history of Discover Financial?

They actually started as a credit card division of the now defunct Sears corp., at one time the powerful department store that is based in Chicago (have you ever heard the Sears tower).

Will regulators approve the deal?

This is mostly a US only deal. Both companies mainly operate in the US. Not a lot of International exposure. I think the regulators will likely approve it, because together they are still not the most dominant credit card issuer or network. Here is a Bloomberg report on the deal (YouTube).

A word on digital wallet

I noticed digital wallet such as Paypal can automatically update the expiration date of the card on the file. This is a neat feature.

中文简译

Translate those two companies into Chinese. They don’t have heavy presence in China, Discover was there, in my vague memory.

Capital One Financial Corp. – 美国第一资本投资国际集团: 美国第一资本投资国际集团(Capital One Financial Corp.,下“Capital One公司”)是一家以投融资及基金管理为基础,集国际贸易、项目开发、投资银行业务为一体的多元化国际企业集团,总部位于美国特拉华州。

Discover Financial Service – 发现金融服务公司: 发现卡(Discover Card)是一种在美国广泛使用的信用卡。1985年到2007年,由美国金融寡头摩根士丹利等金融机构控股,零售商公司Sears推广发行。(Wikipedia)